- Trendline

- Posts

- Trendline Charts #62

Trendline Charts #62

Tuesday's Top 5 charts & Insights

Welcome back to Trendline, where I share 5 best charts on Investing trends in every email.

Let’s dive into today’s post.

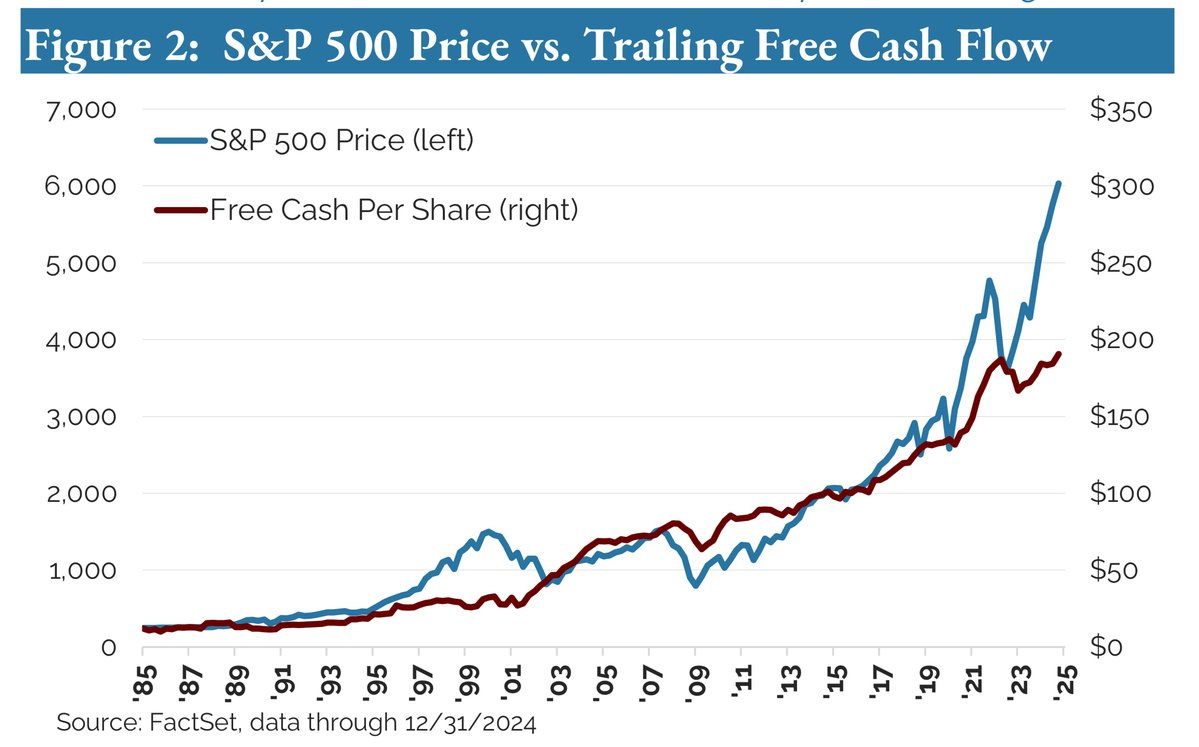

1) Price vs. Free Cash Flow: In the long run market follows free cash flow. Looking at the chart, it seems like we are due a correction of 10%+. Will we see one in 2025?

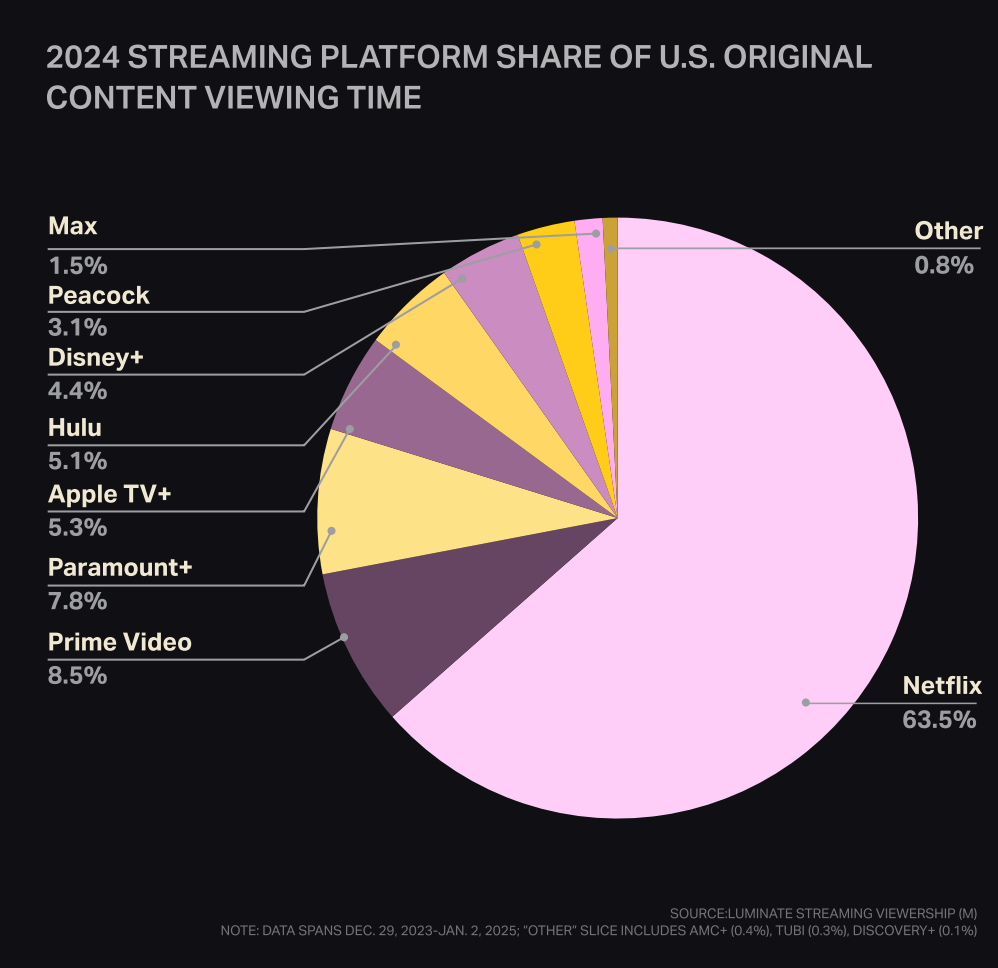

2) Netflix is the king of streaming: Netflix has over 63% market share in terms of viewing time of original content. Their heavy investments in making original content seems to be paying off. Stock is trading close to its ATH.

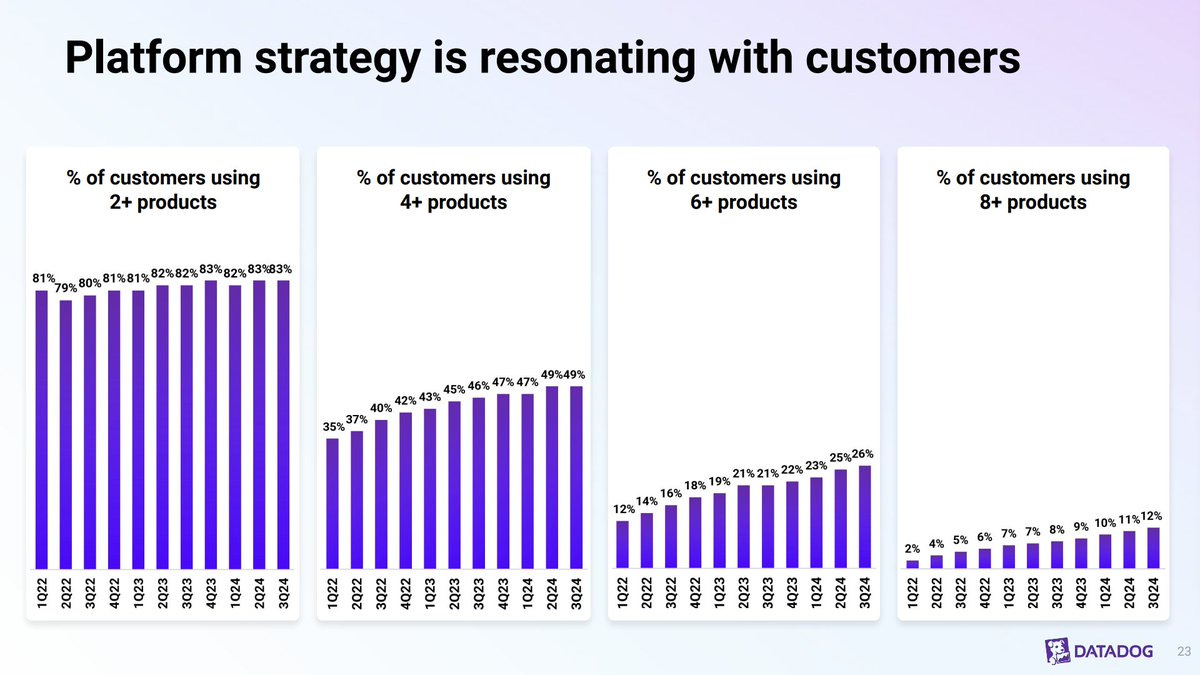

3) Datadog’s platform strategy: “Datadog is one of the best examples of a software company executing a multi-product adoption platform strategy in public markets”

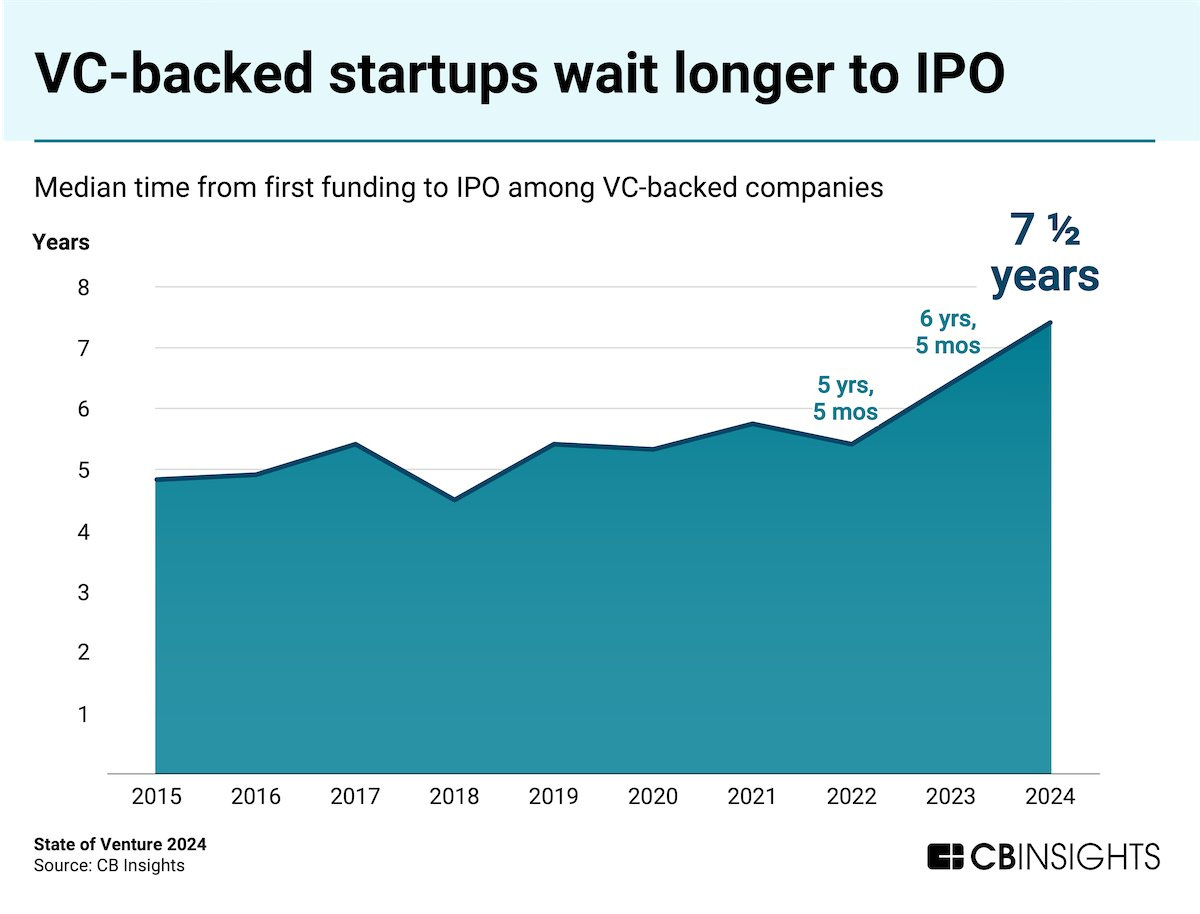

4) IPO wait getting longer for VC backed startups: From first funding to IPO, VC-backed companies that went public in 2024 waited a median of 7.5 years. That’s 2 years longer than in 2022. Investors are still waiting for popular VC-backed companies like Stripe, Databricks and Canva to go public.

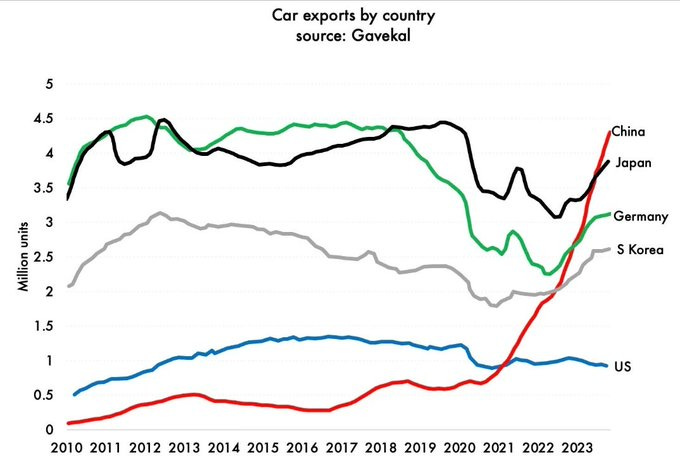

5) China’s car exports have overtaken the world: From low-cost manufacturing to car exports, China has steadily climbed up the value chain. What can’t they make?

Which chart did you find most insightful? |

Reply